Most agency and SaaS leaders do not wake up and decide to take compliance risks.

It usually happens slowly.

A contractor becomes “basically full-time.”

A teammate in another country gets added to Slack, attends daily standups, and works set hours.

Payments go out through Wise or Payoneer.

Everything runs smoothly, until it doesn’t.

That grey zone is what we call “almost compliant” hiring. It feels operationally fine, but legally it is fragile. And the longer it goes on, the more expensive it gets.

This article breaks down what “almost compliant” really costs, why it shows up at the worst possible moment, and how an Employer of Record model fixes it without slowing growth.

What “Almost Compliant” Actually Looks Like

“Almost compliant” global hiring usually includes a few common patterns:

- Team members working like employees, but classified as contractors

- No local employment contracts that meet in-country requirements

- No payroll tax withholding or statutory contributions

- No formal HR framework for leave, termination, or protection

- No documented compliance trail for audits, buyers, or investors

On paper, it looks like flexible hiring. In reality, it is a risk stack that grows silently as your team scales.

The Hidden Costs No One Sees Until It Hurts

1. Misclassification risk becomes a real liability

When someone is treated like an employee but paid like a contractor, it creates exposure. If a dispute happens, or if authorities investigate, you are stuck proving the relationship was compliant.

Even if you “win,” you still pay in time, legal fees, and leadership distraction.

2. Your payroll becomes unpredictable

Global hiring should help you control payroll. But in the grey zone, costs can spike fast:

- back taxes

- penalties

- forced payroll restructuring

- emergency legal cleanup

- rushed rehiring under pressure

That is the opposite of payroll control.

3. Deals and audits expose the cracks

Most teams do not get flagged during day-to-day operations.

They get flagged when the stakes rise:

- a funding round

- a due diligence process

- a strategic partnership

- an acquisition

- a compliance audit

Suddenly, “we’ve been paying contractors” becomes a blocker. Investors and buyers do not want grey zones. They want clean, documented compliance.

4. You lose trust with your team

When employment isn’t structured, it impacts retention. People feel the uncertainty even if they never say it. Top performers tend to choose stability, especially when they have options.

Why This Keeps Happening to Good Companies

Because most leaders are solving for speed.

Hiring globally is often driven by real business needs:

- you need talent now

- you need margin protection

- you want to scale without payroll bloat

- you want specialists you cannot hire locally

The mistake is thinking compliance has to slow you down.

It doesn’t, if you use the right model.

How EOR Fixes It Without Killing Momentum

An Employer of Record model is built for one thing: legal, structured global hiring without requiring you to set up a local entity.

Here’s how it works:

Step 1: The EOR becomes the legal employer

The employee is hired legally in their country under compliant contracts and payroll structures.

Step 2: You manage the work

You still direct their daily responsibilities, workflows, and performance expectations.

Step 3: Compliance is handled end to end

Payroll, taxes, statutory requirements, and HR compliance are managed properly in-country.

You keep control. You remove risk.

That is the entire point.

What This Changes for Agencies and SaaS Teams

When EOR is done correctly, you get:

- clean payroll and compliance documentation

- predictable employment structure for scaling

- fewer legal and HR surprises as headcount grows

- easier audits, vendor approvals, and investor conversations

- stronger retention because your team has stability

It is a business decision that protects margin and protects momentum.

Where RepStack Fits In: Pakistan-Specialized EOR

Many global EOR providers are built to be broad. They cover many countries, but they are not deeply operational inside one.

RepStack is different.

We provide a Pakistan-specialized Employer of Record system designed specifically for agencies and SaaS teams hiring and managing talent in Pakistan.

That means:

- compliant local employment contracts

- payroll processing and tax withholding

- statutory compliance handled in-country

- reporting and time tracking support

- optional insurance, training, and development support

Teams can be fully compliant in as little as 24 hours, without setting up a local entity or creating internal HR overhead.

If you already have team members in Pakistan, or you plan to hire there in 2026, this is one of the fastest ways to protect your business while staying lean.

A Simple Gut Check

If any of these are true, you are likely operating in the grey zone:

- your “contractor” works set hours and reports to a manager

- they are embedded in your systems like a full-time employee

- you do not have local employment contracts

- you are not withholding taxes or meeting local payroll requirements

- you are preparing for growth, funding, or an audit

It does not mean your business is doing something wrong.

It means you have outgrown the informal version of global hiring.

Next Step: Get Clarity Before It Becomes Expensive

If you want to pressure-test your current setup and understand what compliant hiring looks like, you have two options:

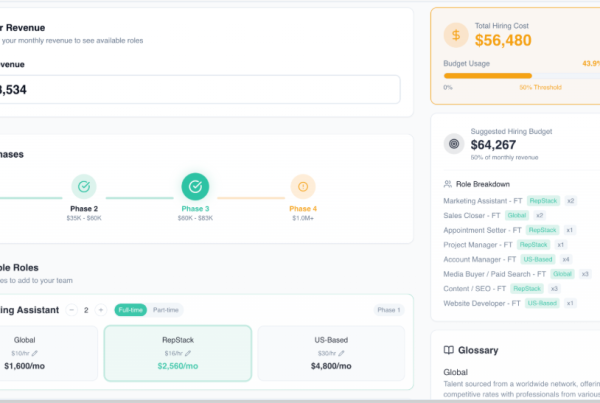

- Use the Team Growth Calculator to map your hiring plan to revenue and payroll thresholds

https://tools.repstack.co/ - Book a Discovery Call to review your hiring structure, risk exposure, and next hires with a clear plan

https://repstack.co/